Bitcoin Network's Maturing Phase Reflected in Post-Halving Fee Stability

By: TOGRP

August 31, 2024 10:30 PM / 0 Comments Banking and Finance Crypto Legal In Brief News Science Blockchain

The Bitcoin network, a decentralized powerhouse in the world of digital finance, has undergone significant evolution since its inception. One of the most telling signs of its maturation is the stability of transaction fees observed following the most recent halving event. This stability, which contrasts with the volatility seen in earlier phases of Bitcoin's lifecycle, indicates a more mature and robust network, capable of supporting a growing user base while maintaining economic viability.

Understanding Bitcoin Halving and Its Impact

Bitcoin halving is a critical event in the lifecycle of the cryptocurrency, occurring approximately every four years. During a halving, the reward for mining new blocks is cut in half, reducing the rate at which new bitcoins are created. This mechanism is built into Bitcoin’s protocol to control inflation and ensure a finite supply of the cryptocurrency.

The Mechanics of Bitcoin Halving

Bitcoin operates on a fixed supply principle, with a maximum of 21 million bitcoins that can ever be mined. The halving event reduces the block reward— the amount of new Bitcoin awarded to miners—by 50%. This reduction happens every 210,000 blocks, which translates to roughly every four years.

Historical Perspective on Halving Events

Historically, Bitcoin halving events have been associated with significant market activity. In previous halvings, the reduction in supply led to increased demand, driving up the price of Bitcoin. However, these events also brought about increased transaction fees as the network adjusted to the reduced block reward.

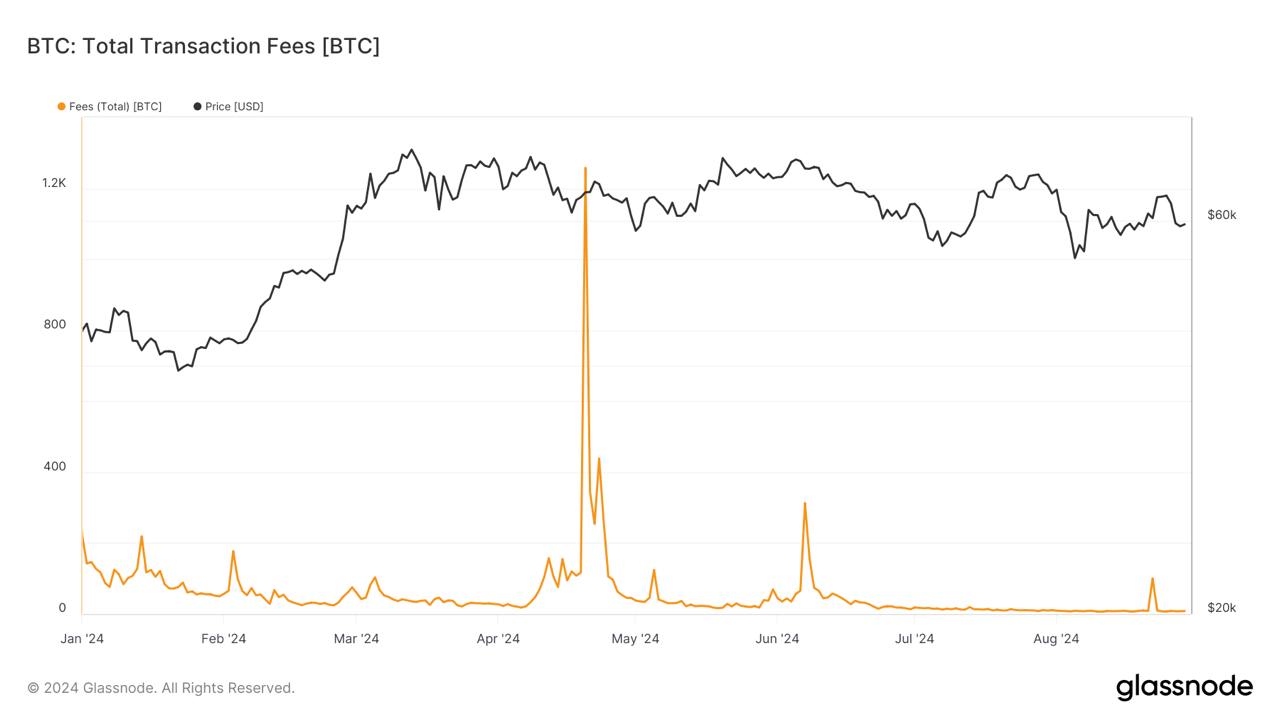

Post-Halving Fee Stability: A Sign of Maturation

The most recent halving event, which took place in May 2020, marked a significant shift in the Bitcoin network's behavior. Unlike previous halvings, where fee volatility was pronounced, this time, the network exhibited a remarkable degree of fee stability.

Analyzing the Post-Halving Fee Environment

Following the May 2020 halving, transaction fees on the Bitcoin network remained relatively stable. This stability is indicative of a more balanced network where supply constraints are better managed, and market participants have adjusted their behavior accordingly.

Factors Contributing to Fee Stability

Several factors have contributed to the post-halving fee stability, including:

-

Increased Network Efficiency: Advances in the Bitcoin protocol, such as Segregated Witness (SegWit) and the Lightning Network, have improved transaction efficiency, reducing the load on the main blockchain and keeping fees stable.

-

Market Maturity: As the Bitcoin market matures, participants are becoming more sophisticated. They better understand network dynamics and are more strategic in their transaction timing, helping to maintain fee stability.

-

Miner Adaptation: Miners have adapted to the reduced block reward by focusing on transaction fees as a primary source of income, which has led to more consistent fee levels.

Implications for Bitcoin’s Future

The fee stability observed post-halving suggests that Bitcoin is entering a new phase of maturity. This stability is crucial for the long-term sustainability of the network, as it ensures that transaction costs remain predictable and manageable, even as block rewards diminish.

The Role of Technology in Supporting Fee Stability

Technological advancements within the Bitcoin network have played a critical role in maintaining fee stability. As the network has evolved, so too have the tools and protocols that support it.

Segregated Witness (SegWit)

SegWit, an upgrade to the Bitcoin protocol introduced in 2017, has been instrumental in enhancing the efficiency of Bitcoin transactions. By separating transaction signatures from the main data, SegWit effectively increases the block size limit, allowing more transactions to be processed without increasing fees.

The Lightning Network

The Lightning Network is another key innovation that has contributed to fee stability. As a second-layer solution, the Lightning Network allows for off-chain transactions, significantly reducing the burden on the main blockchain. This reduction in on-chain activity helps keep transaction fees low, even during periods of high demand.

The Economic Dynamics of Bitcoin Fees

Understanding the economic dynamics that drive Bitcoin transaction fees is essential to appreciating the significance of the current stability.

Supply and Demand in the Bitcoin Network

Like any market, Bitcoin’s transaction fees are influenced by the principles of supply and demand. When the network is congested, and demand for transactions exceeds the available block space, fees increase. Conversely, when demand is lower, fees tend to decrease.

The Role of Miners in Fee Dynamics

Miners play a crucial role in the Bitcoin network’s fee structure. As they prioritize transactions with higher fees, users who want their transactions confirmed quickly are incentivized to pay more. Over time, however, as the network matures, miners have become more efficient at managing the balance between transaction fees and the processing capacity of the network.

Fee Market and Long-Term Sustainability

The stability in transaction fees post-halving indicates that Bitcoin’s fee market is becoming more sustainable. As block rewards continue to decrease, transaction fees will become an increasingly important source of income for miners, making stability essential for the long-term health of the network.

Challenges and Opportunities Ahead

While the stability in Bitcoin transaction fees is a positive sign, the network still faces challenges as it continues to grow and evolve.

Scaling Issues

Scaling remains one of the biggest challenges for the Bitcoin network. As more users adopt Bitcoin, the demand for transactions will increase, potentially leading to higher fees if the network does not continue to evolve technologically.

Regulatory Pressures

As Bitcoin becomes more mainstream, regulatory pressures are likely to increase. How the network and its participants respond to these pressures will be critical in maintaining its stability and appeal.

Future Technological Innovations

The future of Bitcoin depends on continued technological innovation. Developments like Schnorr signatures and Taproot, which are expected to be implemented in the near future, could further enhance the efficiency and security of the network, contributing to fee stability.

Conclusion

The post-halving stability in Bitcoin transaction fees is a clear indication of the network’s maturation. As technological advancements continue to improve the efficiency of transactions and the market becomes more sophisticated, Bitcoin is increasingly seen as a stable and viable financial system. However, challenges remain, and the network must continue to evolve to maintain this stability in the face of growing adoption and regulatory scrutiny.

FAQs

1. What is Bitcoin halving?

Bitcoin halving is an event that occurs approximately every four years, where the reward for mining new Bitcoin blocks is halved, reducing the supply of new bitcoins entering the market.

2. How has Bitcoin's fee stability improved post-halving?

Post-halving, Bitcoin's transaction fees have remained stable due to increased network efficiency, market maturity, and miner adaptation to the reduced block rewards.

3. What role does technology play in maintaining Bitcoin fee stability?

Technologies like Segregated Witness (SegWit) and the Lightning Network have improved transaction efficiency, reducing congestion and helping to keep fees stable.

4. Why are transaction fees important for Bitcoin's future?

As block rewards decrease over time, transaction fees will become a primary source of income for miners, making fee stability crucial for the network’s long-term sustainability.

5. What challenges does Bitcoin face in maintaining fee stability?

Bitcoin faces challenges such as scaling issues, regulatory pressures, and the need for ongoing technological innovation to ensure that fee stability can be maintained as the network grows.