Deep Dive into Bitcoin's Dormancy: Analyzing the Circulating Supply Stagnation

By: TOGRP

May 11, 2024 6:47 AM / 0 Comments Banking and Finance Blockchain In Brief News ZentaNewsDesk

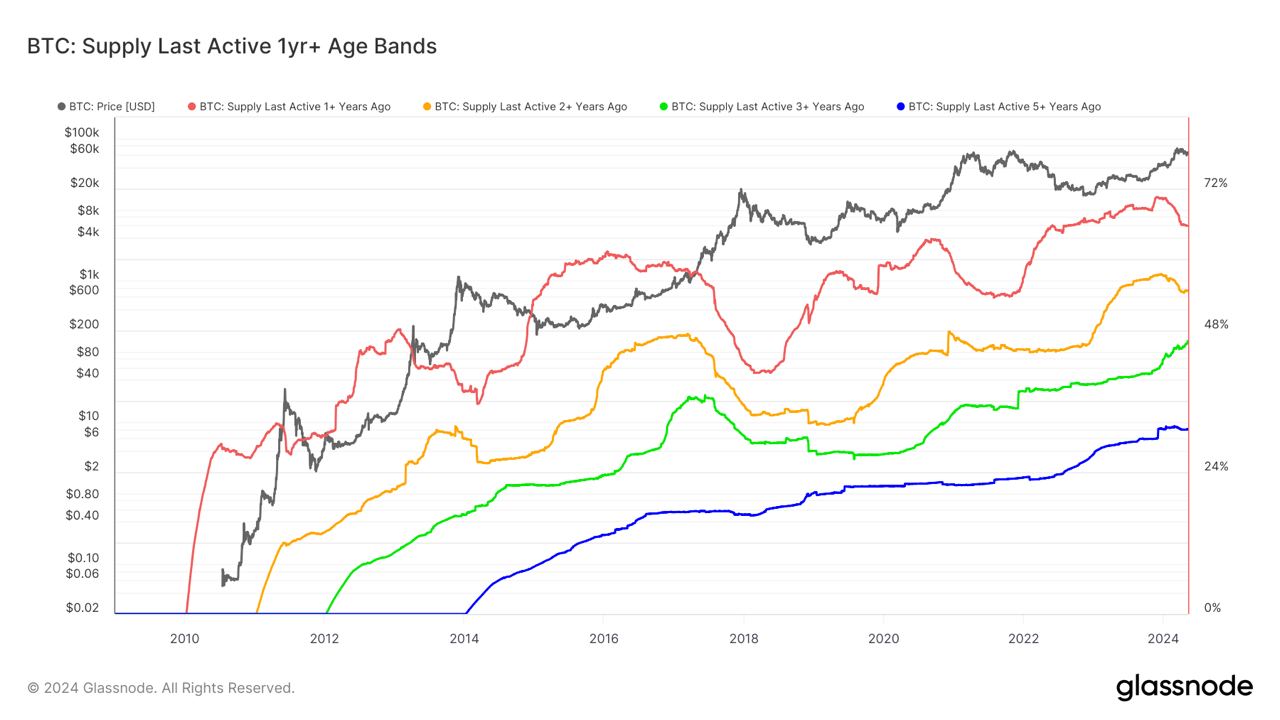

A significant portion of Bitcoin's circulating supply, over 46%, has not been moved or traded in the last three years. This remarkable statistic sheds light on the behavior of Bitcoin holders and has various implications for the cryptocurrency market.

Understanding Bitcoin's Circulating Supply

What Does 'Not Moved' Mean?

In the context of Bitcoin, 'not moved' refers to coins that have remained in the same wallet without being transacted or sold. This can be interpreted as a sign of long-term holding (or "HODLing") among investors who believe in the future appreciation of Bitcoin.

Scale of Dormancy

The fact that nearly half of Bitcoin's circulating supply has been dormant reflects a significant level of confidence among holders. It suggests that a large portion of investors are treating Bitcoin as a store of value, similar to gold.

Implications of High Dormancy Rates

Market Stability

A high dormancy rate can contribute to market stability. With fewer bitcoins actively traded, volatility may decrease, making Bitcoin a more attractive investment for those looking for stable returns.

Price Impact

Conversely, this dormancy can also lead to reduced market liquidity, potentially causing price spikes when large volumes of Bitcoin are suddenly sold or bought. The scarcity of active bitcoins can amplify price movements in response to market demands.

Factors Contributing to Holding Behavior

Economic Uncertainty

Many holders may be retaining their bitcoins as a hedge against economic uncertainty, particularly in light of global financial instability and inflation concerns. Bitcoin offers a decentralized alternative that some view as safer than traditional assets.

Speculative Holding

Another factor is speculative holding, where investors hold onto their assets in anticipation of future price increases. Given Bitcoin's historical price trends, many believe that the cryptocurrency will see substantial gains in the years to come.

Challenges and Considerations

Market Concentration

Such a high level of dormant bitcoins also raises questions about market concentration and the control that a few large holders might exert over the market. If a significant amount of Bitcoin is concentrated in a few hands, these entities could potentially manipulate market conditions to their advantage.

Future Movements

The eventual movement of these dormant bitcoins could significantly impact the market. If a large percentage of holders decide to sell their holdings, there could be dramatic price drops. Conversely, if more investors choose to hold, this could further limit supply and drive prices up.

Conclusion

The statistic that over 46% of Bitcoin's circulating supply hasn't moved in three years highlights the strong holding behavior among Bitcoin investors. This trend has profound implications for market dynamics, influencing both stability and liquidity. As Bitcoin continues to mature, understanding the motivations behind these holding patterns will be crucial for both current and prospective investors.